When it comes to banking, one of the most important considerations is ensuring that your money is safe and secure. The Federal Deposit Insurance Corporation (FDIC) is an independent federal agency that provides deposit insurance to U.S. member banks. Its primary responsibility is to insure deposits in the event of a bank failure. In this article, we’ll explore what the FDIC is, how it works, and why it’s important to have FDIC insurance coverage.

What is the FDIC?

The FDIC was created in 1933 as a response to the Great Depression. Its purpose was to foster trust between consumers and financial institutions by providing insurance coverage for deposits in banks. Today, the FDIC insures deposits at over 5,000 U.S. banks and savings associations.

How Does the FDIC Work?

If a bank fails, the FDIC steps in to ensure that depositors are protected. FDIC insurance is backed by the full faith and credit of the U.S. government, which means that the government guarantees your funds will always be accessible in an FDIC-insured bank. Each depositor is covered up to $250,000 per person, per bank, and per account type. Accounts with different legal ownership are insured separately.

Why Do You Need FDIC Insurance Coverage?

Bank failure occurs when a bank is unable to meet its financial obligations to its depositors and creditors. Before the creation of the FDIC, millions of families lost their entire life savings during the Great Depression. Today, while bank failures are relatively rare, they still occur. Since 2000, there have been 565 bank failures, most of which happened after the 2008 financial crisis.

FDIC insurance coverage provides peace of mind that your funds are protected in the event of a bank failure. The FDIC proudly proclaims on its website that no depositor “has ever lost a penny of insured deposits since the FDIC was created in 1933.”

What Does FDIC Insurance Cover?

FDIC insurance covers deposit accounts, such as checking and savings accounts, money market deposit accounts, and certificates of deposit (CDs).

Below is a list from FDIC website on what it covers:

However, FDIC insurance does not cover other types of investments, such as stocks, bonds, and mutual funds. It also does not cover safe deposit boxes or their contents, U.S. Treasury bills, bonds, or notes (which are backed by the full faith and credit of the U.S. government), life insurance policies, annuities, or crypto assets.

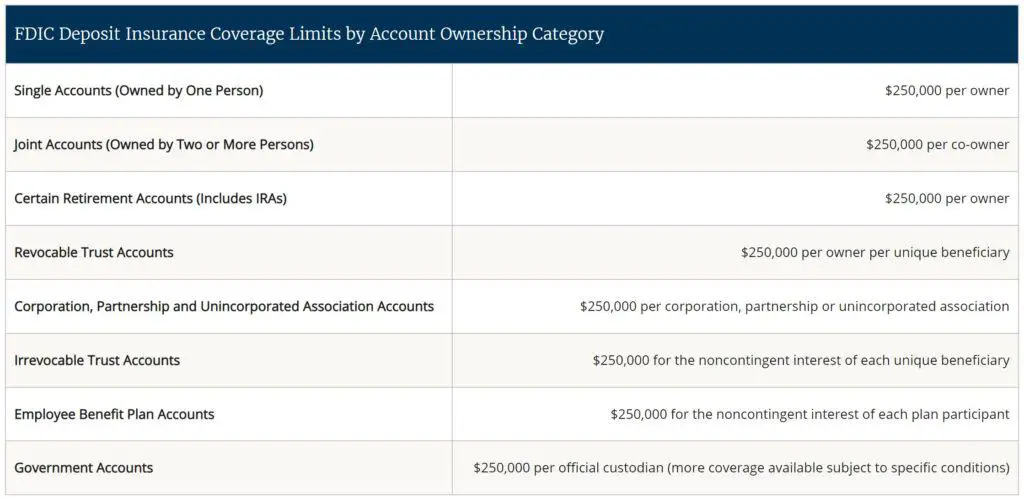

How Much Does FDIC Insurance Cover?

Each depositor is covered up to $250,000 per person, per bank, and per account type. If you have deposit accounts at two different FDIC-insured banks, you are covered up to $250,000 at each one. If you own a joint checking or savings account with someone, the account is insured up to $500,000 — $250,000 for each account holder.

FDIC insurance coverage is automatic for depositors and there is no need to apply for it separately. As long as you open a deposit account at an FDIC-insured bank or financial institution, your deposits are automatically insured. To ensure that your funds are covered by FDIC insurance, you just need to make sure you place your money in a deposit product at the bank.

Does My Bank Provide FDIC Coverage?

Most banks and savings associations in the U.S. are FDIC-insured. You can easily check if your bank is FDIC-insured by visiting your bank’s website or contacting the bank directly.

Final Thoughts

FDIC insurance is essential for maintaining trust, stability, and confidence in the U.S. financial system. When you deposit your money into an FDIC-insured bank, you can rest assured that your funds have some degree of protection in the event of a bank failure. It’s important to understand what FDIC insurance covers and to make sure that your bank is FDIC-insured.