Saving tips that you can implement now! (update 2025)

When it comes to personal finance tips, developing good money saving habits can greatly improve your financial situation. In this article, we’ll explore the top 5 money saving habits you can adopt today to improve your cash flow and save money on expenses.

Reviewing Your Monthly Expenses

This is an excellent approach to determining where your expenses are coming from. This entails keeping track of where you spend your money. Examine your bank account and credit card statements to see where the majority of your costs are coming from. This will help you determine which bucket has to be reduced the most in order to save the most money. It will also highlight certain places where you may not have expected to spend so much money but are.

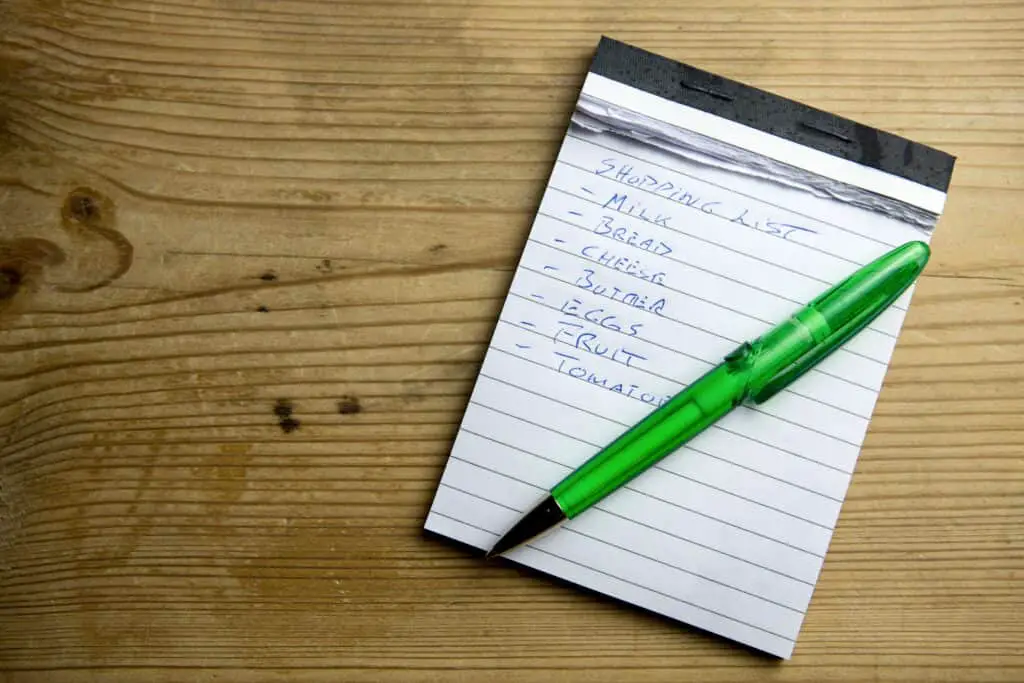

Grocery list

Are you guilty of going to the grocery store and buying things you don’t actually need? I, too, have been that person. Making a grocery list and sticking to it is one of the best methods to save money on groceries. This will assist you avoid purchasing unnecessary items and will save you money.

Shop around for Better Deals: A Simple Money Saving Habit

It is always best to browse around while going shopping, and this also applies to grocery shopping. When you shop around, you may get a sense of how much each item costs at other stores or websites. This allows you to get the best deal possible on your purchases.

Use Coupons and discount codes

When looking to make a purchase, it is usually beneficial to check for where can I receive discounts. A simple Google search for the product or website can generate several coupons you were unaware existed. Another option is to join up for the website where you intend to make the buy and wait for deals. However, you must exercise caution because they may send you a large number of products and offers that you do not require.

Live frugally: An Effective Money Saving Habits

Try looking for free activities in your area; you don’t always need to spend so much on entertainment. The variety of choices you discover may surprise you. Reduce your eating out is another place that will soon save you a lot of money. As an alternative, begin cooking at home. You will immediately save money because cooking at home is less expensive than eating out.

By adopting these money-saving habits, you can improve your cash flow and develop good financial habits. Whether it’s by reviewing your monthly expenses, creating a grocery list, shopping around, using coupons and discounts, or living frugally, every small step can make a difference in your financial health.

Pingback: How to Save Money on Groceries Without Compromising on Quality - JJs FinClub