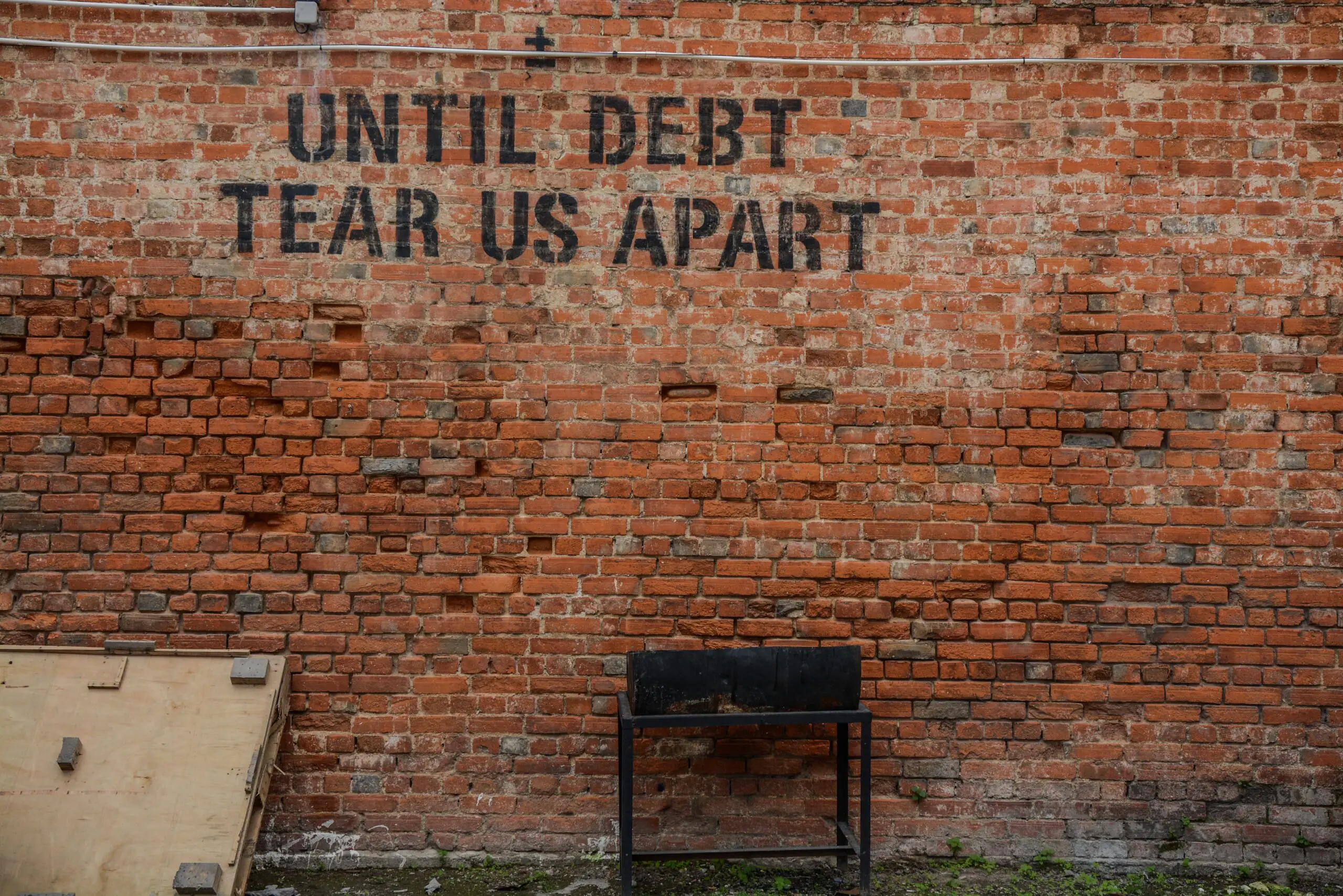

Types of Consumer Debts and Mastering Effective Debt Management

Consumer debts play a significant role in the financial lives of many individuals. Whether it’s credit card debt, mortgage debt, or student loan debt, understanding and effectively managing these debts are vital for long-term financial stability. In this article, we will explore different types of consumer debts and provide practical strategies for effective debt management.

I. Types of Consumer Debts

A. Credit Card Debt

Credit card debt is one of the most prevalent types of consumer debts. It refers to the amount owed on credit cards for purchases, cash advances, or balance transfers. Many individuals find themselves burdened with high-interest credit card debt, which can quickly accumulate if not managed properly.

- Characteristics and Features: Credit card debt typically carries higher interest rates compared to other forms of debt. It allows individuals to make purchases on credit, with a minimum monthly payment required.

- Potential Consequences: Failure to make timely payments can result in late fees, increased interest rates, and damage to credit scores. High credit card balances can also limit an individual’s ability to access additional credit or loans.

- Tips for Managing Credit Card Debt: To effectively manage credit card debt, it is essential to create a budget, track expenses, and make more than the minimum payment each month. Paying off credit card balances in full can save individuals from unnecessary interest charges.

B. Mortgage Debt

For most individuals, a mortgage represents a significant long-term financial commitment. Managing mortgage debt requires careful planning and financial discipline.

- Understanding Mortgage Debt: Mortgage debt is incurred when purchasing a home. It involves borrowing money from a lender to finance the purchase, with the home serving as collateral.

- Factors Affecting Mortgage Debt: The amount of mortgage debt depends on factors such as the purchase price, down payment, interest rate, and loan term.

- Strategies for Managing Mortgage Debt: Making regular mortgage payments on time is crucial. Additionally, individuals can consider refinancing options if interest rates drop, as this may help reduce monthly payments or shorten the loan term. Exploring bi-weekly payment plans can also accelerate mortgage payoff.

C. Auto Loan Debt

Auto loan debt is another common type of consumer debt, incurred when purchasing a vehicle. Effectively managing auto loan debt can save individuals money and provide financial security.

- Overview of Auto Loan Debt: Auto loan debt refers to the amount borrowed to purchase a vehicle. It is repaid in monthly installments over a specific term.

- Tips for Managing Auto Loan Debt: Before taking out an auto loan, it’s important to research and compare loan terms and interest rates from different lenders. Making consistent monthly payments is crucial to avoid defaulting on the loan. Paying off the loan as quickly as possible can reduce overall interest charges.

D. Student Loan Debt

Student loan debt is a significant financial burden for many individuals, especially those pursuing higher education. Managing student loan debt effectively is essential for long-term financial well-being.

- Understanding Student Loan Debt: Student loan debt is taken on to finance education-related expenses, such as tuition, books, and living costs.

- Repayment Options and Programs: There are various repayment options available for student loans, including standard repayment plans, income-driven repayment plans, and loan forgiveness programs.

- Strategies for Managing Student Loan Debt: It is important to understand the terms of student loans, create a budget, and make consistent payments. If struggling to make payments, individuals can explore income-driven repayment plans or loan consolidation options. Communicating with the loan servicer is crucial if facing financial hardship.

E. Medical Debt

Medical debt can arise unexpectedly and place a significant financial burden on individuals. Effectively managing medical debt can help individuals navigate this challenging situation.

- Causes and Challenges of Medical Debt: Medical debt can result from high healthcare costs, insufficient insurance coverage, or unexpected medical emergencies. It can be emotionally and financially stressful.

- Negotiating Medical Bills and Payment Plans: When facing medical debt, individuals can review medical bills carefully for errors or inaccuracies. It is also possible to negotiate payment plans or discounts with healthcare providers to make the debt more manageable.

- Assistance Programs for Managing Medical Debt: Depending on the situation, there may be assistance programs, charity organizations, or grants available to help individuals manage medical debt. Researching and exploring these options can provide much-needed relief.

F. Personal Loan Debt

Personal loans are unsecured loans that individuals can use for various purposes. Understanding personal loan debt and managing it effectively is crucial for financial well-being.

- Exploring Personal Loan Debt: Personal loans allow individuals to borrow money for personal expenses without collateral. The loan terms and interest rates vary based on factors such as creditworthiness and the lender’s policies.

- Repayment Strategies and Options: Making regular payments on time is essential to manage personal loan debt effectively. Individuals can consider various repayment strategies, such as prioritizing higher-interest loans or exploring debt consolidation options to simplify payments.

- Balancing Personal Loan Debt with Other Financial Goals: When managing personal loan debt, individuals should consider their overall financial situation and balance debt repayment with other financial goals, such as saving for emergencies or retirement.

G. Payday Loan Debt

Payday loans are short-term, high-interest loans that are typically due on the borrower’s next payday. Managing payday loan debt can help individuals break free from the cycle of debt and regain financial stability.

- Understanding Payday Loans and Their Risks: Payday loans often target individuals who need quick access to cash but may have high fees and interest rates. Borrowers are required to repay the loan in a short time frame, often with their next paycheck.

- Alternatives to Payday Loans: Individuals facing financial emergencies can explore alternatives to payday loans, such as borrowing from family or friends, seeking assistance from local community organizations, or utilizing credit union payday alternative loans.

- Tips for Avoiding the Cycle of Payday Loan Debt: Breaking the cycle of payday loan debt requires careful budgeting, creating an emergency fund, and exploring healthier financial alternatives. Building a strong financial foundation can help individuals avoid relying on payday loans.

H. Tax Debt

Tax debt arises when individuals owe money to tax authorities due to unpaid taxes or inaccuracies in tax filings. Managing tax debt effectively is essential to avoid serious consequences.

- Overview of Tax Debt: Tax debt can occur if individuals fail to pay their taxes on time, accurately report income, or claim improper deductions. It can result in penalties, interest charges, and potential legal actions.

- Options for Resolving Tax Debt: Individuals with tax debt can explore options such as installment agreements, offers in compromise, or requesting a temporary delay in collection efforts. Seeking professional help from tax experts or tax resolution firms can provide guidance and expertise in resolving tax debt.

- Seeking Professional Help for Managing Tax Debt: Tax matters can be complex, and seeking professional help from tax attorneys, enrolled agents, or certified public accountants (CPAs) can ensure individuals navigate the process effectively and make informed decisions regarding their tax debt.

I. Utility Debt

Utility debt refers to unpaid bills for essential services such as electricity, water, or gas. Managing utility debt effectively is crucial for maintaining access to these vital services.

- Common Types of Utility Debt: Utility debt can accumulate due to missed or late payments on utility bills. It can lead to service disconnections, late fees, and additional charges.

- Communicating with Utility Providers: To manage utility debt, individuals should proactively communicate with utility providers to discuss payment options, negotiate payment plans, or inquire about available assistance programs.

- Budgeting and Prioritizing Utility Payments: Creating a budget that prioritizes utility payments can help individuals avoid falling behind on these crucial bills. Allocating funds for utilities ensures access to essential services and prevents additional fees or disconnections.

II. Impact on Credit Scores and Credit Reports

Consumer debts have a significant impact on credit scores and credit reports. It’s crucial for individuals to understand how debts affect their creditworthiness and the importance of monitoring their credit reports for accuracy.

- Credit Scores and Consumer Debts: Consumer debts, including credit card debt, mortgage debt, student loan debt, and others, contribute to an individual’s credit utilization and payment history, which are key factors in determining credit scores.

- Credit Reports and Consumer Debts: Consumer debts are reflected in individuals’ credit reports, including the types of debts, outstanding balances, payment history, and any delinquencies or defaults.

- Maintaining Good Credit and Managing Debts: By managing consumer debts responsibly, making timely payments, and avoiding excessive debt, individuals can maintain good credit scores and ensure positive credit report profiles.

III. Debt Management Strategies

To effectively manage consumer debts, several strategies can be employed to regain control of finances and work towards becoming debt-free.

A. Budgeting for Debt Management

Creating a budget is the foundation of effective debt management. It helps individuals track income and expenses, identify areas where spending can be reduced, and allocate funds towards debt repayment.

- Developing a Personal Budget: Start by listing all sources of income and tracking monthly expenses. Categorize expenses into fixed (e.g., rent, utilities) and variable (e.g., groceries, entertainment). Identify areas where spending can be reduced to free up more money for debt repayment.

B. Debt Consolidation

Debt consolidation involves combining multiple debts into a single loan or credit account. It simplifies repayment by consolidating various payments into one and potentially reducing interest rates.

- Understanding Debt Consolidation: Debt consolidation allows individuals to merge multiple debts, such as credit card balances or personal loans, into a single loan or credit account. This simplifies the repayment process and can potentially lower overall interest charges.

- Types of Debt Consolidation: There are different methods of debt consolidation, including balance transfer credit cards, personal loans, home equity loans, or debt management plans offered by credit counseling agencies.

- Considerations for Debt Consolidation: Before opting for debt consolidation, individuals should carefully assess their financial situation, compare interest rates and terms, and determine if consolidation will genuinely benefit them in the long run.

C. Negotiating with Creditors

Negotiating with creditors can lead to improved repayment terms, reduced interest rates, or even debt settlement options.

- Contacting Creditors: When facing financial hardship or struggling to make debt payments, individuals can reach out to their creditors to discuss possible solutions. Creditors are often willing to work with borrowers to find mutually beneficial arrangements.

- Exploring Repayment Options: Creditors may offer options such as temporary payment deferrals, reduced interest rates, or extended repayment terms. It’s important to communicate openly and provide necessary documentation to support requests for modified repayment plans.

D. Professional Debt Management Services

Seeking help from professional debt management services can provide expert guidance, debt consolidation plans, and negotiations with creditors.

- Credit Counseling Agencies: Credit counseling agencies can provide individuals with financial education, budgeting assistance, and personalized debt management plans. These agencies often negotiate with creditors on behalf of individuals to secure more favorable repayment terms.

- Debt Settlement Companies: In certain situations, individuals may consider working with debt settlement companies. These companies negotiate with creditors to settle debts for less than the full amount owed. However, it’s essential to research and select reputable and trustworthy companies to avoid scams or unethical practices.

Conclusion

Effectively managing consumer debts is crucial for maintaining financial stability and reducing stress. By understanding the different types of consumer debts and implementing strategic debt management strategies, individuals can take control of their financial future and work towards becoming debt-free. Whether it’s creating a budget, exploring debt consolidation options, negotiating with creditors, or seeking professional help, there are various approaches to consider. With determination, discipline, and proper financial planning, individuals can regain control over their finances and pave the way for a healthier and more secure financial future.