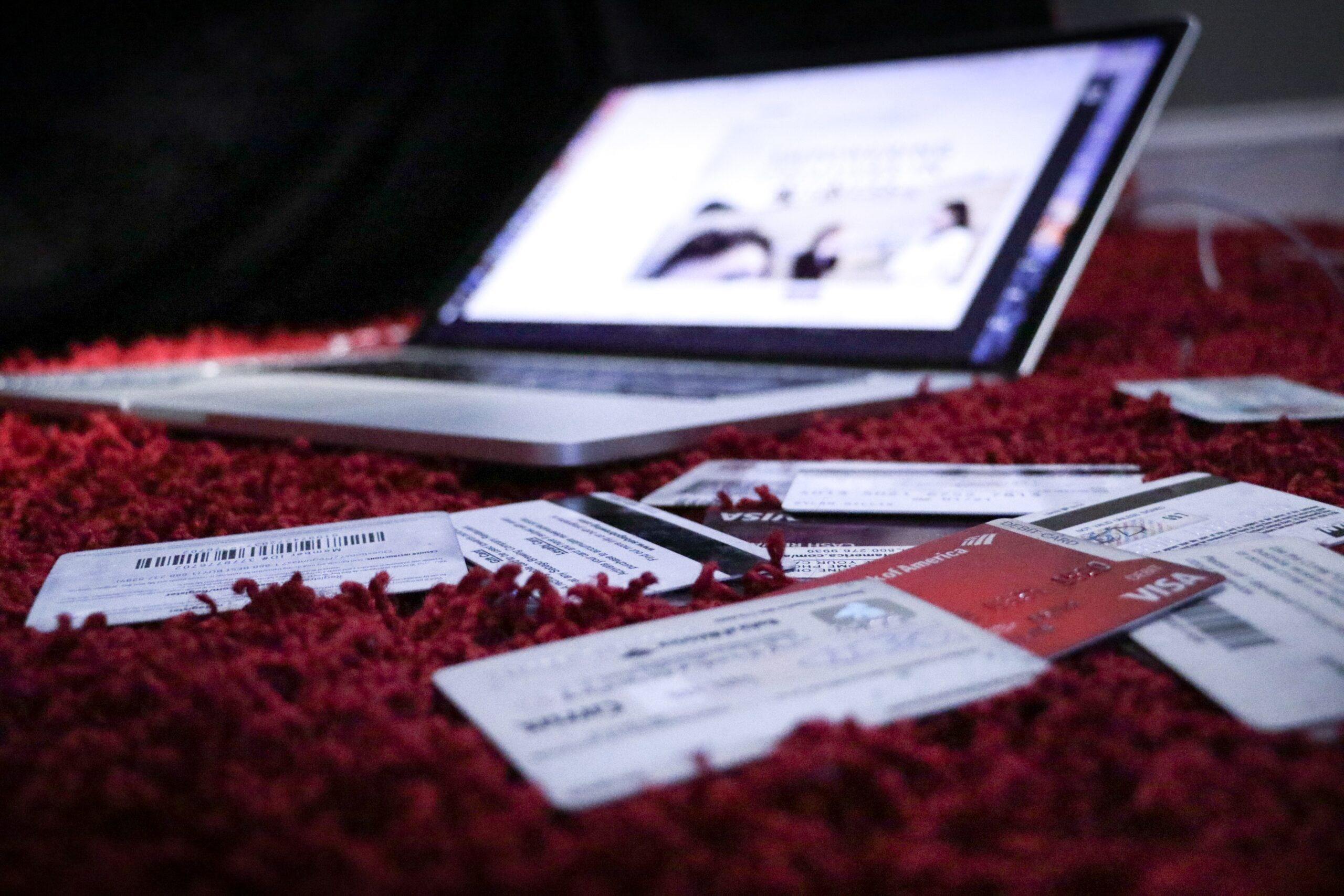

Credit card debt can be a significant source of stress and financial burden for many people. It’s easy to get into credit card debt, but it can be much harder to get out of it. High interest rates and fees can quickly add up, making it difficult to pay off the balance. If you’re struggling with credit card debt and want to become debt-free quickly, there are several strategies you can use to pay it off fast. In this article, we’ll explore five ways to pay off credit card debt fast, so you can regain control of your finances.

How can you pay off your credit card debt quickly

Increase your monthly payments

Making two payments per month instead of one can help reduce your average daily balance and lower the amount of interest you pay. If you are on weekly or bi-weekly wages, try making the same frequency of payments to reduce your debt too. For example, instead of paying $500 at the end of the month, you could make two payments of $250 in the middle and at the end of the month.

Consider a balance transfer

If you have high-interest credit card debt, transferring the balance to a card with a lower interest rate can help you save money and pay off the debt faster. Look for cards with introductory 0% interest rates and make sure to pay off the balance before the promotional period ends. This will remove the interest payments you would otherwise make to the credit card company.

Negotiate for a lower interest rate on your credit card debt

Contact your credit card company and ask if they can lower your interest rate. Research competitor cards with better rates and use them as leverage. Even a small reduction in your interest rate can save you hundreds of dollars in the long run.

Cut back on expenses

Review your monthly expenses and find areas where you can cut back. This could mean reducing your dining out budget, canceling subscriptions, or finding ways to save on groceries. Every dollar saved can be put towards paying off your credit card debt.

Sell items you no longer need

Consider selling items you no longer need or use to generate extra cash. You can sell items online through various websites, such as eBay or Facebook Marketplace. The extra money can be used to pay off your credit card debt faster

Quick recap on how to pay off your credit card debt

Paying off credit card debt can be a daunting task, but it’s possible to achieve it with some dedication and smart strategies. By increasing your monthly payments, negotiating for a lower interest rate, considering a balance transfer, cutting back on expenses, and selling items you no longer need, you can make significant progress towards becoming debt-free. Remember to create a budget, track your progress, and stay motivated along the way. With patience and discipline, you can pay off your credit card debt faster than you thought possible.

If you like this article, you can also check out a previous article on “5 easy steps to manage debt” to additional tips.

Pingback: Types of Consumer Debts and Effective Debt Management - JJs FinClub